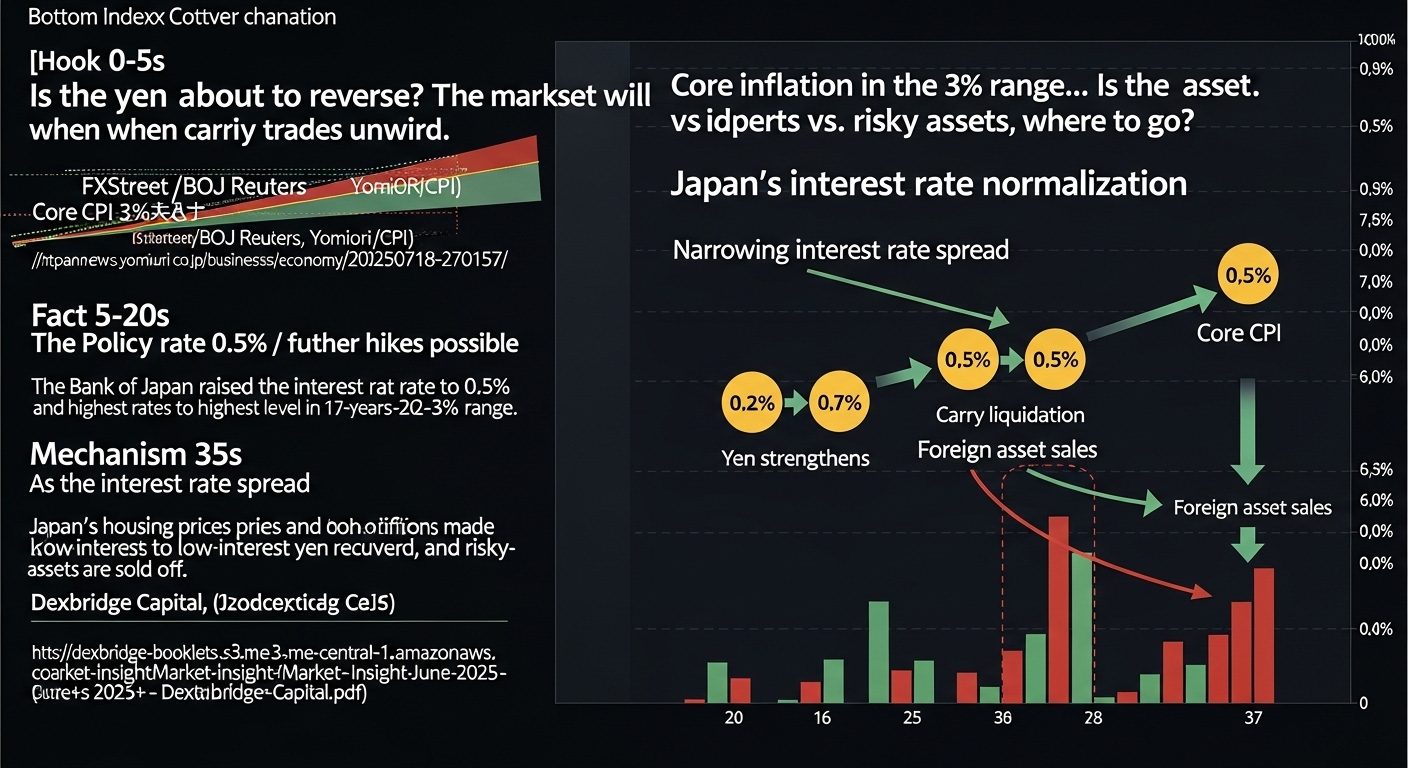

“코어 물가 3%대… 아베노믹스 시대 종료?” 일본의 금리 정상화"

"일본 집값·물가 동반 상승, 통화 완화 유지 어렵다"

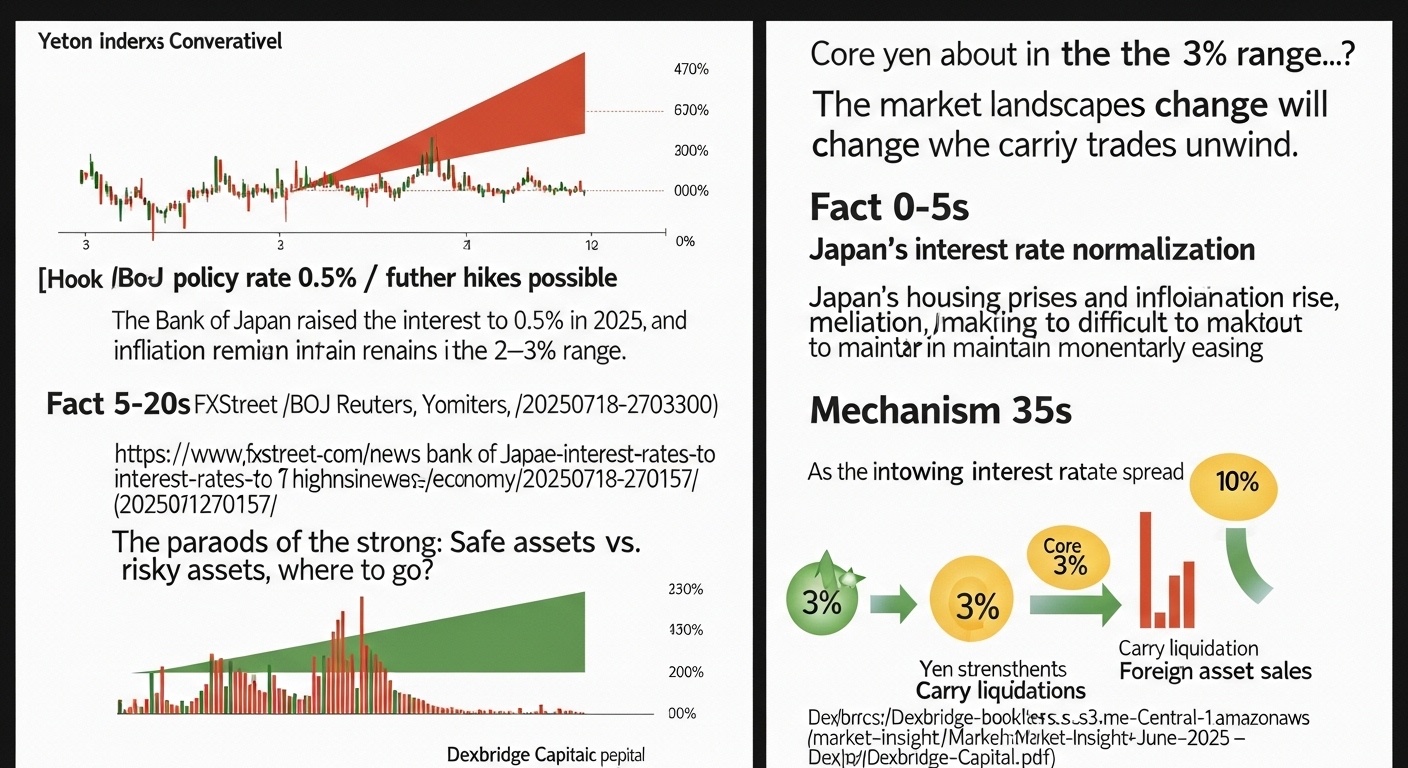

“엔 강세의 역설: 안전자산 vs 위험자산, 어디로?”

“엔화가 장기 바닥에서 쐐기형으로 수렴 중입니다. 반전이 오면, 글로벌 시장의 질서가 바뀔 수 있어요.”

“일본은행은 2025년 정책금리를 0.5%로 올렸고, 물가는 2~3%대에 머물고 있습니다. 추가 인상 가능성도 열어뒀죠.”

(출처: FXStreet/BOJ, Yomiuri/ING) [1](https://www.fxstreet.com/news/bank-of-japan-set-to-raise-interest-rates-to-highest-level-in-17-years-202501232300)[12](https://japannews.yomiuri.co.jp/business/economy/20250718-270157/)[3](https://think.ing.com/snaps/bojs-rate-hike-probability-grows-due-to-strong-inflationary-pressures/)

“금리차가 줄면 엔화가 강해집니다. 그 순간, 저금리 엔화로 빌려 해외 자산에 투자하던 ‘엔 캐리’는 청산에 들어가죠.”

(출처: Dexbridge Capital, 학술 보고서) [5](https://dexbridge-booklets.s3.me-central-1.amazonaws.com/market-insight/Market+Insight+June+2025+-+Dexbridge+Capital.pdf)[6](https://www.iises.net/proceedings/international-conference-on-economics-finance-business-london-2025/table-of-content?cid=151&iid=014&rid=16864)

“결과는? 과열된 증시 섹터 변동성 확대, 채권·금·원자재까지 가격 재조정이 이어질 수 있습니다.”

(출처: Traders On Trend/ainvest) [9](https://tradersontrend.com/2025/05/22/the-unwinding-yen-carry-trade-and-its-impact-on-u-s-treasuries-and-gold-prices/)[10](https://www.ainvest.com/news/yen-carry-trade-unwinding-implications-global-equity-exposure-2507/)

“엔 캐리 청산이 실제로 시작됐다고 보시나요? ‘조정 온다’ vs ‘버틴다’—댓글로 남겨주세요. 구독과 알림 설정도 잊지 마세요!”

'사회(시사)' 카테고리의 다른 글

| “3년간 폭등! 미국 주식 TOP3… 진짜 승자는 누구?” (0) | 2025.11.10 |

|---|---|

| “S&P 500 붕괴 신호? AI 버블의 끝인가!” (4) | 2025.11.10 |

| “MS가 ‘인간 중심 초지능’을 공식 선언했습니다. 첫 목표? 바로 ‘의료’입니다.” (0) | 2025.11.10 |

| 아무것도 아닌 사람에게 로저비비에? 부담 없이 우아함 주는 법 (0) | 2025.11.08 |

| "올해 국민연금, 자산이 1,400조를 넘겼다는 뉴스… 진짜일까요?" (5) | 2025.11.08 |